One business account. Borderless by design.

Buy, sell, send, receive, and spend in traditional and digital currencies, all from a single, secure platform built for modern business.

Trusted by Leaders. Built with the Best.

Why choose Banqeta?

-

Built for Business

Operate confidently with both traditional and digital currencies — all from one secure, unified platform trusted by companies in 130+ countries.

-

Seamless Global Scale

Whether you’re scaling or managing international operations, Banqeta’s infrastructure simplifies cross-market and cross-currency transactions — without extra complexity.

-

Proven Infrastructure

Banqeta is built on Google Cloud and Visa’s global infrastructure, with trusted partners like Rail, Endava, and Stripe — delivering secure, scalable performance from day one.

Operate like a local, wherever you do business

Banqeta connects you to the world’s payment infrastructure, open accounts with local payment access, send and receive in traditional and digital currencies, spend globally with a Virtual Visa card, and move money across borders in seconds. Manage everything from one platform, without the delays or complexity of legacy systems.

traditional currencies with local account details and payment rails

digital currencies with dedicated wallets and blockchain access

payment networks across traditional rails and blockchain protocols

countries where you can send traditional and digital currency payments

Your global business toolkit

Multi-Currency Accounts

Open named business accounts in USD, GBP, EURO and AED connected to domestic payment networks for faster, lower-cost local transactions, plus full access to SWIFT global payment rails. Move between currencies with transparent, competitive FX. Available to companies in 130+ countries.

Digital Currency Wallets

Buy, sell, send, and receive digital currencies with complete control. Each wallet is asset-specific with advanced security, instant conversion, and full on/off ramp support. Use digital assets for treasury, payments, or revenue collection. Banqeta does not charge fees to send or receive digital currency.

Virtual Visa Cards

Virtual Visa cards provide a secure and convenient way to manage payments online. They can be used instantly for purchases across websites and digital platforms, giving businesses and their teams fast access to funds without the need to wait for a physical card.

banqit™ Network

Near-instant, fee-free transfers between Banqeta users in the same currency. Whether you’re paying a supplier, settling with a client, or sending an invoice to another user, Banqit™ makes it effortless, connecting traditional and digital currencies in one seamless global network.

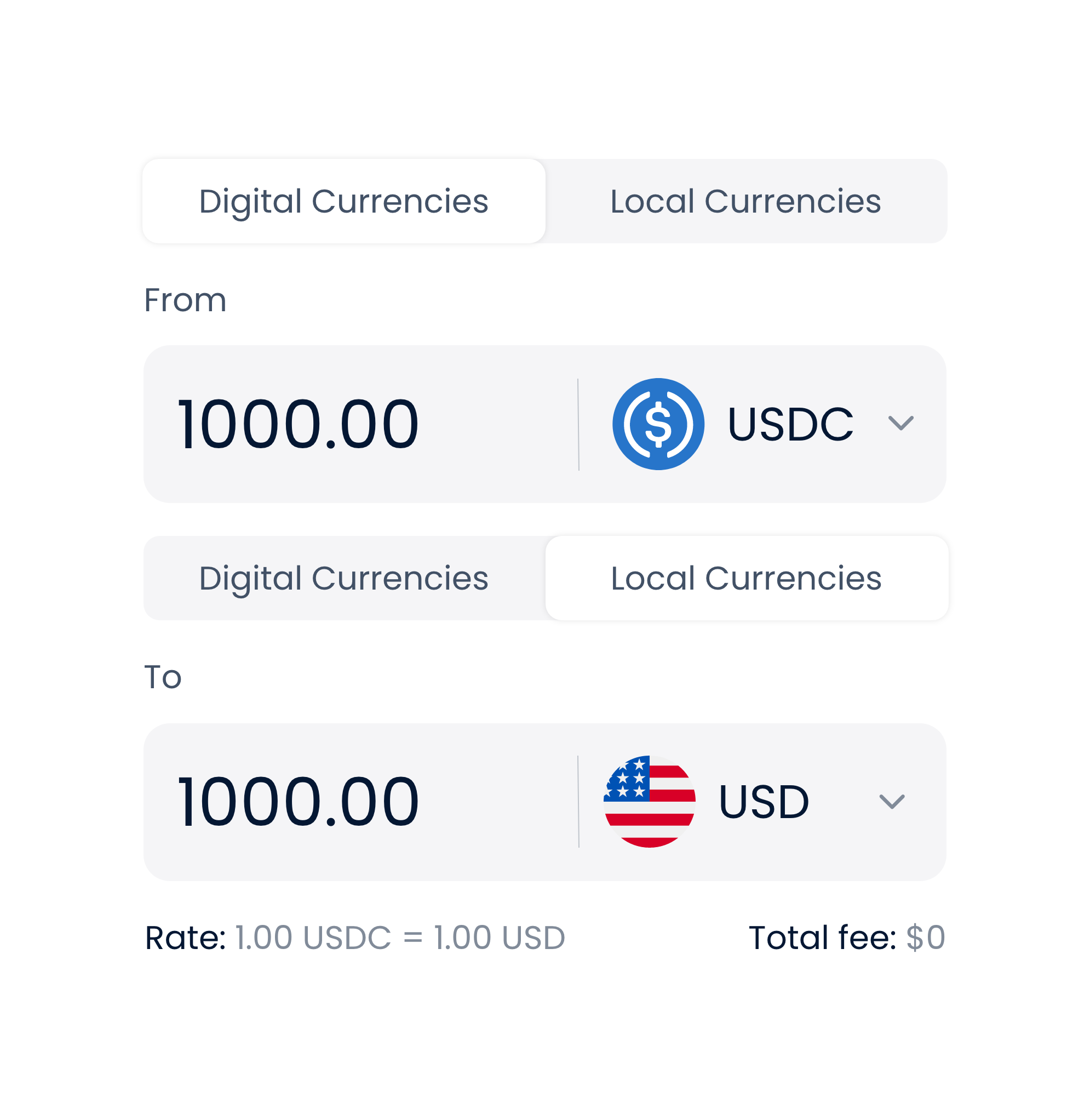

On/Off Ramps

Easily fund your account or withdraw funds using traditional or digital currency, with seamless access anytime. Transparent pricing, no hidden fees, and no delays, giving you full confidence and control.

FX and Transfers

Send money globally with competitive FX rates and faster settlement. Banqeta supports cost-effective transfers using local payment networks and supported blockchain infrastructure.

Why operate in both traditional and digital currency?

Security measures

Security is our top priority. We use advanced encryption protocols, multi-factor authentication, and continuous monitoring to safeguard your data and funds. Regular audits and updates ensure Banqeta stays ahead of emerging threats.

Build your own

financial platform

Banqeta’s white-label infrastructure powers businesses that want to launch a branded version of our platform. We handle licensing, compliance, technology, and support while you focus on sales, marketing, and growth.

Referral partners

Introduce businesses to Banqeta, to open an account or launch their own white-label platform, and earn for the lifetime of the relationship. Our programme is open globally. If you're looking to enhance your current services or have a network we can support, partner with us to deliver value and earn meaningful commissions.